In this week’s recap: Inflation takes center stage.

THE WEEK ON WALL STREET

In a volatile trading week, stocks extended their losses as economic growth and inflation concerns soured investor sentiment.

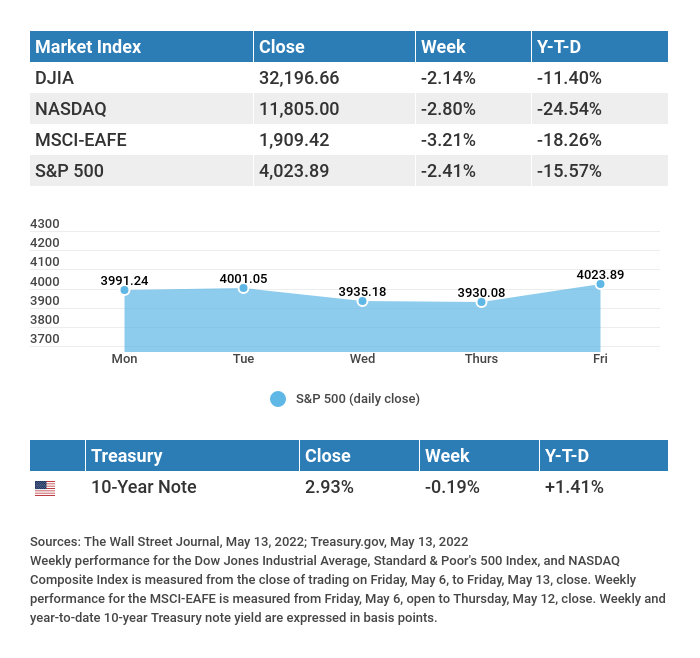

The Dow Jones Industrial Average dropped 2.14%, while the Standard & Poor’s 500 lost 2.41%. The Nasdaq Composite index fell 2.80% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slumped 3.21%.1,2,3

A TURBULENT WEEK

Inflation moved to center stage last week with the release of April’s Consumer Price Index (CPI) and the Producer Price Index. Both numbers came near their 40-year highs but were lower than March’s year-over-year numbers. The results heightened investor anxiety about future Fed monetary tightening and its impact on economic growth.

In recent weeks, technology stocks have borne the brunt of the downdraft as investors lightened up on risk exposures, with some of the mega-cap tech names getting swept up in the selling pressure. Cooling import price increases buoyed spirits on Friday, helping spark a rally that reduced the week’s losses.

INFLATION STAYS HOT

Investors were greeted with a mixed CPI report, looking for signs that inflation may be cooling. Year-over-year costs rose 8.3%, slower than the previous month but faster than consensus estimates. Excluding food and energy, core inflation climbed 6.2%. Buried beneath the headline number was a 5.1% yearly increase in shelter costs, the most significant increase since 1991. Shelter costs account for one-third of the CPI.4

Inflation has been a weight on markets all year. Investors are concerned that the persistence of higher prices may tip the economy into recession as increased spending on essential needs crimps consumers’ spending power.

TIP OF THE WEEK

If you’re thinking about selling a business, consider contacting a business broker, one that represents companies like yours. It may make finding an appropriate buyer easier.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Retail Sales. Industrial Production.

Wednesday: Housing Starts.

Thursday: Existing Home Sales. Jobless Claims. Index of Leading Economic Indicators.

Source: Econoday, May 13, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Walmart, Inc. (WMT), The Home Depot, Inc. (HD).

Wednesday: Cisco Systems, Inc. (CSCO), Target Corporation (TGT), Lowe’s Companies, Inc. (LOW), The TJX Companies, Inc. (TJX), Analog Devices, Inc. (ADI).

Thursday: Applied Materials, Inc. (AMAT), Palo Alto Networks, Inc. (PANW), Ross Stores, Inc. (ROST).

Friday: Deere & Company (DE).

Source: Zacks, May 13, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Though we see the same world, we see it through different eyes.” VIRGINIA WOOLF

THE WEEKLY RIDDLE

Name two words in the English language that have the letter “I” twice in the middle of the word.

LAST WEEK’S RIDDLE:

A librarian finds that pages have been ripped out of a novel. Pages 28, 29, 148, 211 and 212 are torn out. Given this, how many separate sheets of paper have been torn from the book?

ANSWER:

4 sheets of paper. Pages 211 and 212 will be on opposite sides of the same sheet of paper

Greg R. Solis, AIF®

President and CEO

Bob Medler, CRPC®, CMFC®, AIF®

Wealth Advisor / Investment Analyst

Tiffany Valentine, CFP®

CERTIFIED FINANCIAL PLANNER™

Vice President | Director of Financial Planning

SOLIS WEALTH MANAGEMENT

78-075 Main Street

Suite 204

La Quinta, CA 92253

Office: (760) 771-3339

Fax: (760) 771-3181

www.soliswealth.com

E-Mail: greg@soliswealth.com

E-Mail: bob@soliswealth.com

E-Mail: tiffany@soliswealth.com

CA Insurance License #0795867, 0C05523 & 0D73175

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested.

This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such.

All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Copyright 2022 FMG Suite.

CITATIONS:

1. The Wall Street Journal, May 13, 2022

2. The Wall Street Journal, May 13, 2022

3. The Wall Street Journal, May 13, 2022

4. CNBC, May 11, 2022