In this week’s recap: Plenty of treats for Wall Street this week.

THE WEEK ON WALL STREET

Stocks overcame poor earnings results from some of America’s largest companies to post gains last week as investors cheered positive earnings surprises, easing inflation and a rebound in economic growth.

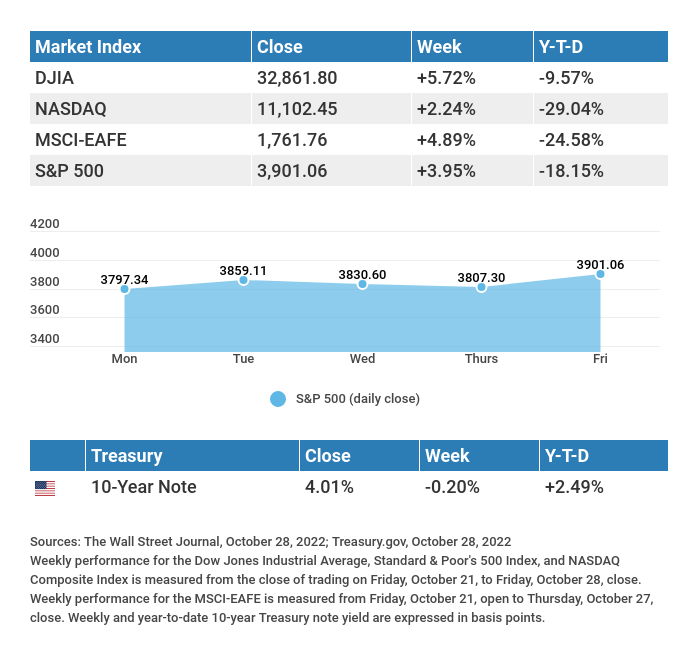

The Dow Jones Industrial Average rose 5.72%, while the Standard & Poor’s 500 advanced 3.95%. The Nasdaq Composite index added 2.24% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, gained 4.89%.1,2,3

A “SPOOK-TACULAR” WEEK

Some mega-cap technology companies were under pressure last week on weak earnings and tepid fourth-quarter guidance. They reported multiple headwinds, including declining advertising revenues, loose expense control, and a slowdown in cloud growth.

Meanwhile, positive earnings surprises from “old economy” companies powered markets higher. This market bifurcation was evident in the divergence in the performance of the Dow Industrials and the Nasdaq. The S&P 500 posted a substantial gain despite its disproportionate weighting of mega-cap stocks, which helped illustrate the power of the rally. Momentum accelerated into Friday, aided by an easing in inflation and a solid third-quarter Gross Domestic Product (GDP) report.

ECONOMIC GROWTH EXCEEDS EXPECTATIONS

After two straight quarters of negative economic growth, the initial estimate of the third quarter’s GDP came in at a solid 2.6%, exceeding economists’ 2.3% estimate. The surprising economic performance was largely attributable to an increase in exports, which narrowed the trade deficit, a development that may not repeat going forward.4

Particularly encouraging was the personal consumption expenditure price index, a report used by the Fed to track inflation. It increased 4.2%, well below the 7.3% jump from a quarter ago.5

TIP OF THE WEEK

How financially literate are your children? Encourage them to read up on investing and money matters before they turn 18.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Institute for Supply Management (ISM) Manufacturing Index. Job Openings and Labor Turnover Survey (JOLTS).

Wednesday: Federal Open Market Committee (FOMC) Announcement. Automated Data Processing (ADP) Employment Report.

Thursday: Jobless Claims. Factory Orders. Institute for Supply Management (ISM) Services Index.

Friday: Employment Situation.

Source: Econoday, October 28, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Pfizer, Inc. (PFE), Eli Lilly & Company (LLY), Marathon Petroleum Corporation (MPC).

Wednesday: CVS Health Corporation (CVS), Qualcomm, Inc. (QCOM), Fortinet, Inc. (FTNT), Humana, Inc. (HUM), Cigna Corporation (CI), Booking Holdings, Inc. (BKNG), Prudential Financial, Inc. (PRU).

Thursday: Block, Inc. (SQ), PayPal Holdings, Inc. (PYPL), Amgen, Inc. (AMGN), ConocoPhillips (COP), Regeneron Pharmaceuticals, Inc. (REGN).

Friday: Dominion Energy, Inc. (D), EOG Resources, Inc. (EOG).

Source: Zacks, October 28, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“We should all do something to right the wrongs that we see and not just complain about them.” JACQUELINE KENNEDY ONASSIS

THE WEEKLY RIDDLE

What is worn by the foot and often bought by the yard?

LAST WEEK’S RIDDLE

They can run side by side for thousands of miles; they are made of steel. While they constantly touch the ground, they seldom meet or touch each other. What are they?

ANSWER

Railroad tracks.

Greg R. Solis, AIF®

President and CEO

Bob Medler, CRPC®, CMFC®, AIF®

Wealth Advisor / Investment Analyst

Tiffany Valentine, CFP®

CERTIFIED FINANCIAL PLANNER™

Vice President | Director of Financial Planning

SOLIS WEALTH MANAGEMENT

78-075 Main Street

Suite 204

La Quinta, CA 92253

Office: (760) 771-3339

Fax: (760) 771-3181

www.soliswealth.com

E-Mail: greg@soliswealth.com

E-Mail: bob@soliswealth.com

E-Mail: tiffany@soliswealth.com

CA Insurance License #0795867, 0C05523 & 0D73175

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested.

This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such.

All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Copyright 2022 FMG Suite.

CITATIONS:

1. The Wall Street Journal, October 28, 2022

2. The Wall Street Journal, October 28, 2022

3. The Wall Street Journal, October 28, 2022

4. CNBC, October 27, 2022

5. CNBC, October 27, 2022