Pullbacks are the stubbed toe of the stock market. I was reminded of this over the last week as I contemplated the recent surge in volatility while picking up toys after our two-year-old finally fell asleep. As I carried a Tonka truck back to its usual parking spot next to the toy farm, I slammed my toe into the foot of the couch. The pain was acute, but not worthy of a full-blown panic. After a few deep breaths, the sting began to wear off and I assessed the damage to find a little redness, but nothing broken. Somewhere in this painful process, the parallels between my toe’s unfortunate encounter with the couch and the recent equity market sell-off became clear. For the market over the last week, the foot of the couch was embodied by overbought conditions — especially in big tech, waning confidence for a soft landing due to weak employment data and a contractionary Institute of Supply Management (ISM) manufacturing reading, and the rapid unwinding of the crowded yen carry trade.

Like a stubbed toe, pullbacks in the market are inevitable, something investors tend to forget during periods of low volatility. When they occur, they tend to be painful and spark fear over something breaking. The market narrative often shifts during these periods as waning optimism manifests into panic, an emotion evident on the CBOE Volatility Index (VIX) last week. The VIX or ‘fear gauge’ surged to its highest reading since March 2020 on August 5 (a rising VIX is associated with increased fear and uncertainty in the market, and vice versa for a falling VIX). We view this move — and its subsequent decline — as a constructive sign, as major spikes in the VIX often overlap near capitulation points in equity markets.

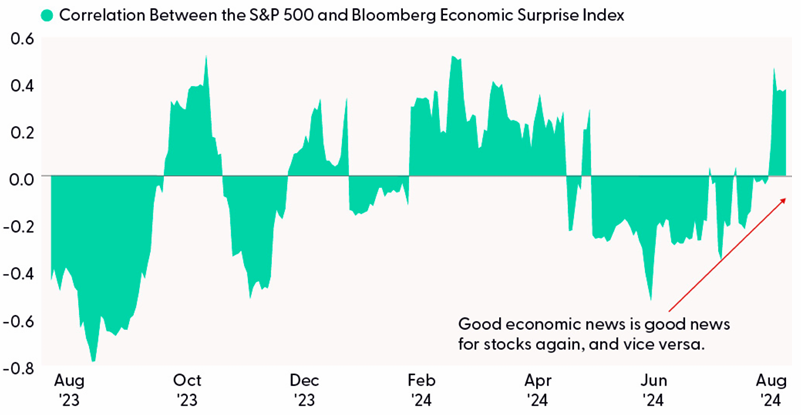

The change in the market narrative became especially pronounced over the last week. The chart below highlights the rolling one-month correlation between the S&P 500 and the Bloomberg U.S. Economic Surprise Index. (For context, the surprise component is based on the percentage difference between an actual economic data release and the median analysts’ forecast.) When the correlation is positive, it implies good economic news is good news for the broader market, and vice versa. When the correlation is negative, good economic news tends to be bad news for the broader market, and vice versa.

As you may notice, the correlation between the market and the economy has recently turned decisively positive. Previously, downside surprises on the economic calendar typically led to a positive response from equity markets, as underwhelming data was translated into higher probabilities for rate cuts. However, bad economic news can only be good news to stocks for so long. As we witnessed over the last week, weak manufacturing and employment data stoked recession fears, and investors responded by selling stocks. In contrast, Thursday’s better-than-expected jobless claims data helped alleviate labor market concerns and underpinned a sizable rally for the S&P 500.

So for now, good economic news is back to being good news for stocks, and vice versa. But that also implies investors may no longer be giving the economy the benefit of the doubt, placing the burden of equity market performance firmly on the back of the U.S. economy.

The Bad News Is Good News Narrative Has Changed

Source: LPL Research, Bloomberg 08/08/24

All indexes are unmanaged and cannot be directly invested into. Past performance is no guarantee of future results.

Turning to the Charts

Technical analysis provides a framework for identifying the market’s trend direction and momentum. Time horizons are an important aspect of assessing the broader market as primary or longer-term trends are usually more durable and powerful than secondary or minor trends — Charles Dow, the “father” of technical analysis, defined the primary trend as the “tide,” while intermediate and minor trends were labeled as “waves” and “ripples.”

For the S&P 500, the longer-term uptrend tracing back to the bear market lows remains intact. Breadth metrics are holding up relatively well as around two-thirds of index constituents remain above their 200 day moving average (dma). Shorter-term technical damage has been more pronounced. The chart below shows the S&P 500 breaking below a series of support levels before finally catching a bid around a key retracement level (5,227). Despite the recent bounce, the risk of additional selling pressure appears elevated as market bottoms are often a process that begin after oversold conditions reach extremes — something yet to fully materialize amid the current pullback. As highlighted in the lower panel, only around 12% of S&P 500 stocks have reached oversold levels based on the Relative Strength Index (RSI), well below readings above 20% that typically overlap with market bottoms. Based on this backdrop, there is insufficient technical evidence to make the case that a durable bottom has formed.

S&P 500: A Bounce or Bottom?

Source: LPL Research, Bloomberg 08/08/24

All indexes are unmanaged and cannot be directly invested into. Past performance is no guarantee of future results.

History as a Guide

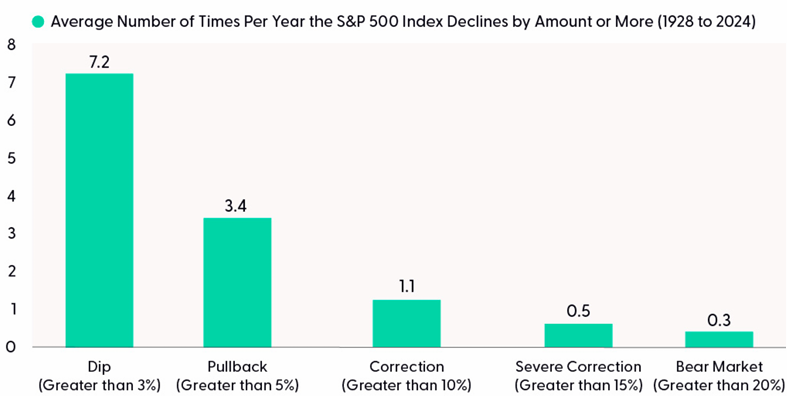

As you can imagine, it has been a busy couple of weeks for LPL Research as our team published an array of content related to the jump in equity market volatility. To boil down our work into one simple message for investors, don’t panic. While such sharp declines in equity prices are concerning, looking back at historic data on the S&P 500 index reminds us that dips, pullbacks, and even corrections of 10% or more are a normal and healthy part of any bull market. On average, stocks experience a pullback of over 5% over three times per year and a correction of 10% or more around once per year — even in positive years. Expressing this data another way, 94% of years since 1928 have experienced a pullback of at least 5%, and 64% of years have had at least one 10% correction. We believe that how common these occurrences are should provide comfort to equity investors, allowing them to be patient, stay invested, and most importantly, to not panic

Don’t Panic, Dips, Pullbacks, and Even Corrections Are Normal

Source: LPL Research, FactSet 08/08/2024

All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

Carry Trade Crosscurrents

Ultra-low rates and easy monetary policy made the yen an attractive funding currency for the carry trade, where investors borrow in currencies with low rates to fund purchases in higher-yielding securities elsewhere. However, recent tightening from the Bank of Japan (BOJ) — including the first rate hike into positive territory in 17 years — pulled the proverbial thread on this crowded trade, forcing investors to buy back short yen positions. Important to note, these trades often involve high degrees of leverage and when they unravel, especially rapidly, losses can be significant and ultimately end up on the balance sheet of the lender (often a bank).

As highlighted below, a surge in yen buying dragged the dollar/yen down through its longer-term uptrend. The pair finally found its footing near the December lows, where a relief rally off extremely oversold conditions subsequently developed. For context, the RSI indicator reached its lowest level since 1997 last week, a period known as “Asian Contagion” as currency devaluations in the region turned into systemic market risk.

Is the unwinding of the carry trade over? Determining the size of the carry trade can be challenging due to the opaqueness of currency positioning and leveraged transactions. For example, analysts speculate yen carry-trade borrowing could range anywhere from $1 to $4 trillion in total, with recent reports estimating that 75% of carry trades have now been closed. Regardless, the path of least resistance for the dollar/yen is no longer higher, implying risk for additional downside volatility is elevated. Technical analysis provides a framework for assessing this risk, and a close below support at 141 would point to another potential leg lower for the pair. In contrast, a rally back above 152 would recapture the 200-dma and prior uptrend, suggesting reduced carry trade volatility and downside risk.

Is the Unwinding of the Yen Carry Trade Over?

Source: LPL Research, Bloomberg 08/08/24

All indexes are unmanaged and cannot be directly invested into. Past performance is no guarantee of future results.

Summary

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, while actively monitoring for signs of an inflection point during this pullback. LPL Research continues to preach patience before buying the dip, and not to panic. Bottoming is historically a process, and although we welcome the recent bounce, there is insufficient technical evidence supporting the case that a durable low has been set. Potential catalysts for a stock market turnaround include a signal from the Federal Reserve that they will be more aggressive with rate cuts, evidence that the economy is holding up okay — especially the labor market, and increased stability in currency markets. From a technical analysis perspective, we see S&P 500 downside risk to key support near the 200-dma (5,032) or the April lows (4,954) under an adverse scenario. Overall, we expect volatility to remain elevated in the coming months as the market waits for more clarity on the economy and a better seasonal setup (as a reminder, September is the worst month for stocks). The Committee maintains its modest overweight to fixed income, funded from cash, which can help buffer against equity market volatility should economic conditions worsen.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from Bloomberg.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0001659-0724W Tracking # 614588 (Exp. 08/25)

Pullbacks Are Common but Painful | Weekly Market Commentary | August 12, 2024

Pullbacks are the stubbed toe of the stock market. I was reminded of this over the last week as I contemplated the recent surge in volatility while picking up toys after our two-year-old finally fell asleep. As I carried a Tonka truck back to its usual parking spot next to the toy farm, I slammed my toe into the foot of the couch. The pain was acute, but not worthy of a full-blown panic. After a few deep breaths, the sting began to wear off and I assessed the damage to find a little redness, but nothing broken. Somewhere in this painful process, the parallels between my toe’s unfortunate encounter with the couch and the recent equity market sell-off became clear. For the market over the last week, the foot of the couch was embodied by overbought conditions — especially in big tech, waning confidence for a soft landing due to weak employment data and a contractionary Institute of Supply Management (ISM) manufacturing reading, and the rapid unwinding of the crowded yen carry trade.

Like a stubbed toe, pullbacks in the market are inevitable, something investors tend to forget during periods of low volatility. When they occur, they tend to be painful and spark fear over something breaking. The market narrative often shifts during these periods as waning optimism manifests into panic, an emotion evident on the CBOE Volatility Index (VIX) last week. The VIX or ‘fear gauge’ surged to its highest reading since March 2020 on August 5 (a rising VIX is associated with increased fear and uncertainty in the market, and vice versa for a falling VIX). We view this move — and its subsequent decline — as a constructive sign, as major spikes in the VIX often overlap near capitulation points in equity markets.

The change in the market narrative became especially pronounced over the last week. The chart below highlights the rolling one-month correlation between the S&P 500 and the Bloomberg U.S. Economic Surprise Index. (For context, the surprise component is based on the percentage difference between an actual economic data release and the median analysts’ forecast.) When the correlation is positive, it implies good economic news is good news for the broader market, and vice versa. When the correlation is negative, good economic news tends to be bad news for the broader market, and vice versa.

As you may notice, the correlation between the market and the economy has recently turned decisively positive. Previously, downside surprises on the economic calendar typically led to a positive response from equity markets, as underwhelming data was translated into higher probabilities for rate cuts. However, bad economic news can only be good news to stocks for so long. As we witnessed over the last week, weak manufacturing and employment data stoked recession fears, and investors responded by selling stocks. In contrast, Thursday’s better-than-expected jobless claims data helped alleviate labor market concerns and underpinned a sizable rally for the S&P 500.

So for now, good economic news is back to being good news for stocks, and vice versa. But that also implies investors may no longer be giving the economy the benefit of the doubt, placing the burden of equity market performance firmly on the back of the U.S. economy.

The Bad News Is Good News Narrative Has Changed

Source: LPL Research, Bloomberg 08/08/24

All indexes are unmanaged and cannot be directly invested into. Past performance is no guarantee of future results.

Turning to the Charts

Technical analysis provides a framework for identifying the market’s trend direction and momentum. Time horizons are an important aspect of assessing the broader market as primary or longer-term trends are usually more durable and powerful than secondary or minor trends — Charles Dow, the “father” of technical analysis, defined the primary trend as the “tide,” while intermediate and minor trends were labeled as “waves” and “ripples.”

For the S&P 500, the longer-term uptrend tracing back to the bear market lows remains intact. Breadth metrics are holding up relatively well as around two-thirds of index constituents remain above their 200 day moving average (dma). Shorter-term technical damage has been more pronounced. The chart below shows the S&P 500 breaking below a series of support levels before finally catching a bid around a key retracement level (5,227). Despite the recent bounce, the risk of additional selling pressure appears elevated as market bottoms are often a process that begin after oversold conditions reach extremes — something yet to fully materialize amid the current pullback. As highlighted in the lower panel, only around 12% of S&P 500 stocks have reached oversold levels based on the Relative Strength Index (RSI), well below readings above 20% that typically overlap with market bottoms. Based on this backdrop, there is insufficient technical evidence to make the case that a durable bottom has formed.

S&P 500: A Bounce or Bottom?

Source: LPL Research, Bloomberg 08/08/24

All indexes are unmanaged and cannot be directly invested into. Past performance is no guarantee of future results.

History as a Guide

As you can imagine, it has been a busy couple of weeks for LPL Research as our team published an array of content related to the jump in equity market volatility. To boil down our work into one simple message for investors, don’t panic. While such sharp declines in equity prices are concerning, looking back at historic data on the S&P 500 index reminds us that dips, pullbacks, and even corrections of 10% or more are a normal and healthy part of any bull market. On average, stocks experience a pullback of over 5% over three times per year and a correction of 10% or more around once per year — even in positive years. Expressing this data another way, 94% of years since 1928 have experienced a pullback of at least 5%, and 64% of years have had at least one 10% correction. We believe that how common these occurrences are should provide comfort to equity investors, allowing them to be patient, stay invested, and most importantly, to not panic

Don’t Panic, Dips, Pullbacks, and Even Corrections Are Normal

Source: LPL Research, FactSet 08/08/2024

All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

Carry Trade Crosscurrents

Ultra-low rates and easy monetary policy made the yen an attractive funding currency for the carry trade, where investors borrow in currencies with low rates to fund purchases in higher-yielding securities elsewhere. However, recent tightening from the Bank of Japan (BOJ) — including the first rate hike into positive territory in 17 years — pulled the proverbial thread on this crowded trade, forcing investors to buy back short yen positions. Important to note, these trades often involve high degrees of leverage and when they unravel, especially rapidly, losses can be significant and ultimately end up on the balance sheet of the lender (often a bank).

As highlighted below, a surge in yen buying dragged the dollar/yen down through its longer-term uptrend. The pair finally found its footing near the December lows, where a relief rally off extremely oversold conditions subsequently developed. For context, the RSI indicator reached its lowest level since 1997 last week, a period known as “Asian Contagion” as currency devaluations in the region turned into systemic market risk.

Is the unwinding of the carry trade over? Determining the size of the carry trade can be challenging due to the opaqueness of currency positioning and leveraged transactions. For example, analysts speculate yen carry-trade borrowing could range anywhere from $1 to $4 trillion in total, with recent reports estimating that 75% of carry trades have now been closed. Regardless, the path of least resistance for the dollar/yen is no longer higher, implying risk for additional downside volatility is elevated. Technical analysis provides a framework for assessing this risk, and a close below support at 141 would point to another potential leg lower for the pair. In contrast, a rally back above 152 would recapture the 200-dma and prior uptrend, suggesting reduced carry trade volatility and downside risk.

Is the Unwinding of the Yen Carry Trade Over?

Source: LPL Research, Bloomberg 08/08/24

All indexes are unmanaged and cannot be directly invested into. Past performance is no guarantee of future results.

Summary

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, while actively monitoring for signs of an inflection point during this pullback. LPL Research continues to preach patience before buying the dip, and not to panic. Bottoming is historically a process, and although we welcome the recent bounce, there is insufficient technical evidence supporting the case that a durable low has been set. Potential catalysts for a stock market turnaround include a signal from the Federal Reserve that they will be more aggressive with rate cuts, evidence that the economy is holding up okay — especially the labor market, and increased stability in currency markets. From a technical analysis perspective, we see S&P 500 downside risk to key support near the 200-dma (5,032) or the April lows (4,954) under an adverse scenario. Overall, we expect volatility to remain elevated in the coming months as the market waits for more clarity on the economy and a better seasonal setup (as a reminder, September is the worst month for stocks). The Committee maintains its modest overweight to fixed income, funded from cash, which can help buffer against equity market volatility should economic conditions worsen.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from Bloomberg.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

For public use.

Member FINRA/SIPC.

RES-0001659-0724W Tracking # 614588 (Exp. 08/25)

Recent Posts

Categories

SIGN UP TO RECEIVE OUR WEEKLY NEWSLETTER

Sign up to get interesting news and updates delivered to your inbox.