In this week’s recap: Cooling inflation brings market gains.

THE WEEK ON WALL STREET

A cooling inflation number ignited a powerful rally on Thursday, sending stocks to strong gains for the week.

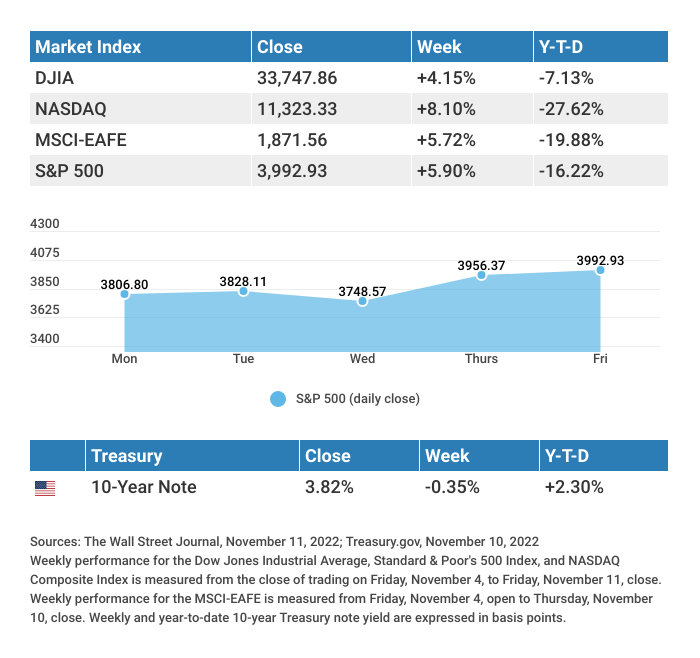

The Dow Jones Industrial Average gained 4.15%, while the Standard & Poor’s 500 added 5.90%. The Nasdaq Composite index rose 8.10% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, picked up 5.72%.1,2,3

STOCKS SURGE

A lower-than-expected inflation report triggered the biggest one-day stock market gain in more than two years as the news raised investors’ hopes that the Fed might consider easing the pace of future rate hikes. The day’s gains were pronounced in the hard-hit technology sector, as the tech-heavy Nasdaq added 7.35%.4

Stocks initially rallied to start the week, but gave up some of the gains on Wednesday following a muddy and indecisive outcome to the midterms. Friday saw stocks build on their gains to close out an exceptional week.

INFLATION MODERATES

Consumer prices rose slower in October, increasing 0.4% for the month and 7.7% from 12 months ago. Both numbers were below market expectations of 0.6% and 7.9%. The core CPI (excludes energy and food sectors) rose a more modest 0.3% on a monthly basis and 6.3% from a year ago.5

The deceleration in prices was mainly attributable to price declines in used cars (-2.4%), apparel (-0.7%), and medical care services (-0.6%). Despite the progress, inflation remains well above the Fed’s 2% target rate. A look behind the numbers shows that October’s 7.7% CPI was fueled by the largest monthly jump in shelter costs since 1990 (+0.8%). Shelter costs account for one-third of the CPI. Energy was up 1.8%, while food costs rose 0.6% for the month.6

TIP OF THE WEEK

Retiring in the near future? A monthly retirement budget is a good idea – and so is a current budget that establishes a schedule for paying down debts and reducing costs before you enter into a new phase of life.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Producer Price Index (PPI).

Wednesday: Retail Sales. Industrial Production.

Thursday: Housing Starts. Jobless Claims.

Friday: Existing Home Sales. Index of Leading Economic Indicators.

Source: Econoday, November 11, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Tyson Foods, Inc. (TSN).

Tuesday: Walmart, Inc. (WMT), The Home Depot, Inc. (HD).

Wednesday: Nvidia Corporation (NVDA), Cisco Systems, Inc. (CSCO), Target Corporation (TGT), Lowe’s Companies, Inc. (LOW), The TJX Companies, Inc. (TJX).

Thursday: Applied Materials, Inc.(AMAT), Palo Alto Networks, Inc. (PANW), Ross Stores, Inc. (ROST).

Source: Zacks, November 11, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“To expect truth to come from thinking signifies that we mistake the need to think with the urge to know.” HANNAH ARENDT

THE WEEKLY RIDDLE

I’m usually standing on a city sidewalk, and I’ll always stand by your car. But if you don’t feed me, I may get you into trouble. What am I?

LAST WEEK’S RIDDLE

Create a 13-letter word using all 13 of the following letters: O A I I S T T R R D N A M

ANSWER

ADMINISTRATOR.

Greg R. Solis, AIF®

President and CEO

Bob Medler, CRPC®, CMFC®, AIF®

Wealth Advisor / Investment Analyst

Tiffany Valentine, CFP®

CERTIFIED FINANCIAL PLANNER™

Vice President | Director of Financial Planning

SOLIS WEALTH MANAGEMENT

78-075 Main Street

Suite 204

La Quinta, CA 92253

Office: (760) 771-3339

Fax: (760) 771-3181

www.soliswealth.com

E-Mail: greg@soliswealth.com

E-Mail: bob@soliswealth.com

E-Mail: tiffany@soliswealth.com

CA Insurance License #0795867, 0C05523 & 0D73175

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested.

This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such.

All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Copyright 2022 FMG Suite.

CITATIONS:

1. The Wall Street Journal, November 11, 2022

2. The Wall Street Journal, November 11, 2022

3. The Wall Street Journal, November 11, 2022

4. CNBC, November 10, 2022

5. CNBC, November 10, 2022

6. CNBC, November 10, 2022