In this week’s recap: Markets down ahead of Thanksgiving holiday.

THE WEEK ON WALL STREET

The stock market edged lower last week as it digested a crosscurrent of conflicting economic data and contrasting comments from Fed officials.

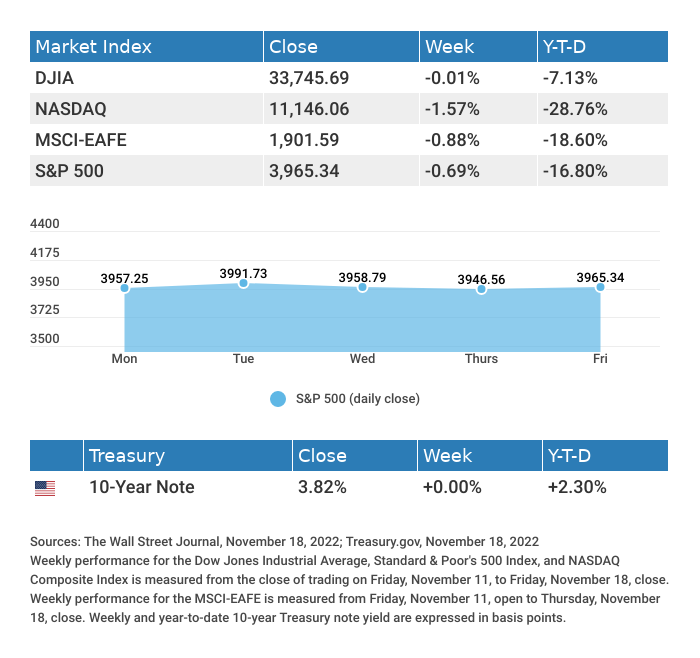

The Dow Jones Industrial Average was flat (-0.01%), while the Standard & Poor’s 500 declined by 0.69%. The Nasdaq Composite index lost 1.57% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, fell 0.88%.1,2,3

STOCKS SLIP

Stocks took a spill after Fed officials’ comments cast uncertainty about future rate hikes. The more hawkish comments soured investor hopes of an imminent easing in Fed rate hikes, a prospect that had helped fuel the market rally the previous week.

Concerns over the hawkish comments raised investor worries over recession risks, anxiety exacerbated by weak housing data and layoff announcements from major technology companies. The economic picture, however, included some encouraging news as retail sales rose and producer price increases moderated.

PRODUCER PRICES EASE

The Producer Price Index (PPI), which reflects the costs paid by domestic producers, seen as an indicator of future consumer prices, is not typically a market-moving event. That was not the case last week.

October’s PPI rose a modest 0.2%, well below the 0.4% consensus estimate. The year-over-year increase moderated to 8.0%, compared to 8.4% in September and the peak of 11.7% in March. The eye-catching element may have been the 0.1% service decline, representing the first decline since November 2020. Excluding food and energy, the PPI was flat for the month and up 6.7% from a year ago.4

A FINAL WORD

We wish you and your family a wonderful Thanksgiving and express our gratitude for the privilege of working with you. Happy Thanksgiving!

TIP OF THE WEEK

While no one likes to think about their funeral, preplanned or prepaid funeral arrangements may be a financially smart move and may relieve your heirs of some stress when the time comes.

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: Durable Goods Orders. Jobless Claims. Purchasing Managers’ Index (PMI) Composite. New Home Sales. Consumer Sentiment. FOMC Minutes.

Source: Econoday, November 18, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Dell Technologies, Inc. (DELL), Zoom Video Communications, Inc. (ZM).

Tuesday: Best Buy Co., Inc. (BBY), Dollar Tree, Inc. (DLTR), Autodesk, Inc. (ADSK), Analog Devices, Inc. (ADI).

Wednesday: Deere & Company (DE).

Source: Zacks, November 18, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“A successful person is one who can lay a firm foundation with the bricks that others throw at him or her.” DAVID BRINKLEY

THE WEEKLY RIDDLE

It has no crown, yet when the chips are down it is more powerful than a king or queen. What is it?

LAST WEEK’S RIDDLE

I’m usually standing on a city sidewalk, and I’ll always stand by your car. But if you don’t feed me, you may get into trouble. What am I?

ANSWER

A parking meter.

Greg R. Solis, AIF®

President and CEO

Bob Medler, CRPC®, CMFC®, AIF®

Wealth Advisor / Investment Analyst

Tiffany Valentine, CFP®

CERTIFIED FINANCIAL PLANNER™

Vice President | Director of Financial Planning

SOLIS WEALTH MANAGEMENT

78-075 Main Street

Suite 204

La Quinta, CA 92253

Office: (760) 771-3339

Fax: (760) 771-3181

www.soliswealth.com

E-Mail: greg@soliswealth.com

E-Mail: bob@soliswealth.com

E-Mail: tiffany@soliswealth.com

CA Insurance License #0795867, 0C05523 & 0D73175

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested.

This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such.

All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Copyright 2022 FMG Suite

CITATIONS:

1. The Wall Street Journal, November 18, 2022

2. The Wall Street Journal, November 18, 2022

3. The Wall Street Journal, November 18, 2022

4. CNBC, November 15, 2022