In this week’s recap: Fed talks turkey on lower rates, boosting markets.

THE WEEK ON WALL STREET

Growing optimism that the Fed may be ready to ease future interest rate hikes sent stocks higher in a quiet trading week.

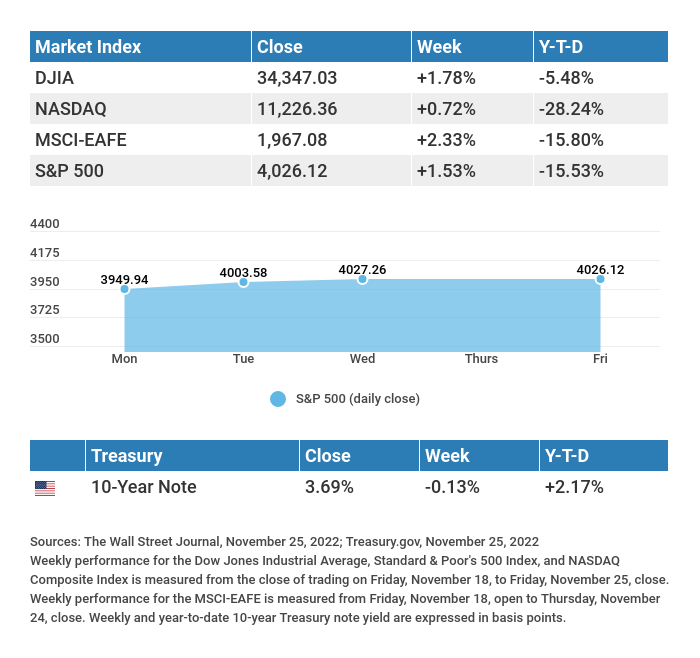

The Dow Jones Industrial Average gained 1.78%, while the Standard & Poor’s 500 added 1.53%. The Nasdaq Composite index improved 0.72% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, advanced 2.33%.1,2,3

STOCKS RALLY

In light holiday-week trading, stocks rallied as investors grew more hopeful of a slowdown in a future rate hike. The release of the minutes from the early November meeting of the Federal Open Market Committee (FOMC) fed investors’ optimism. Fed officials suggested such easing may be coming soon.

Investor sentiment was also lifted by unexpectedly strong retailer earnings, upside surprises in new economic data, and a better-than-expected consumer sentiment reading. Investors looked past the continuing Covid-related challenges that have stymied China’s economic recovery and its attendant implications for global growth.

EASING IN THE OFFING?

The Fed meeting minutes, released before the Thanksgiving holiday, showed that most Fed officials felt a slowing in interest rate increases would be appropriate. The minutes also suggested that such a deceleration in rate hikes may begin with December’s meeting with a 50 basis point hike rather than a fifth consecutive boost of 75 basis points.4

The primary reasons for slowing the pace of rate hikes were the growing risk that the Fed may increase rates beyond what was required to reduce inflation to its two percent target and signs that inflation pressures were easing.5

TIP OF THE WEEK

Set aside a half-hour each month to organize your financial documents. It makes sense all year, and you will be prepared once tax season arrives

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Consumer Confidence.

Wednesday: Gross Domestic Product (GDP). Automated Data Processing (ADP) Employment Report. Jobs Openings and Labor Turnover Survey (JOLTS).

Thursday: Jobless Claims. Purchasing Managers’ Index (PMI) Manufacturing.

Friday: Employment Situation.

Source: Econoday, November 25, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Tuesday: Workday, Inc. (WDAY), Intuit, Inc. (INTU), CrowdStrike (CRWD)

Wednesday: Salesforce, Inc. (CRM)

Thursday: Marvell Technology, Inc. (MRVL), Dollar General Corporation (DG), The Kroger Co. (KR).

Source: Zacks, November 25, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“Challenging power structures from the inside, working the cracks within the system, however, requires learning to speak multiple languages of power convincingly.” PATRICIA HILL COLLINS

THE WEEKLY RIDDLE

A lone pine tree stands on a cliff. The wind is blowing from the east through the mountains. Which way do the tree’s leaves blow?

LAST WEEK’S RIDDLE

It has no crown, yet when the chips are down it is more powerful than a king or queen. What is it?

ANSWER

An ace in a deck of cards.

Greg R. Solis, AIF®

President and CEO

Bob Medler, CRPC®, CMFC®, AIF®

Wealth Advisor / Investment Analyst

Tiffany Valentine, CFP®

CERTIFIED FINANCIAL PLANNER™

Vice President | Director of Financial Planning

SOLIS WEALTH MANAGEMENT

78-075 Main Street

Suite 204

La Quinta, CA 92253

Office: (760) 771-3339

Fax: (760) 771-3181

www.soliswealth.com

E-Mail: greg@soliswealth.com

E-Mail: bob@soliswealth.com

E-Mail: tiffany@soliswealth.com

CA Insurance License #0795867, 0C05523 & 0D73175

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested.

This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such.

All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Copyright 2022 FMG Suite.

CITATIONS:

1. The Wall Street Journal, November 25, 2022

2. The Wall Street Journal, November 25, 2022

3. The Wall Street Journal, November 25, 2022

4. The Wall Street Journal, November 23, 2022

5. The Wall Street Journal, November 23, 2022