Before the jobs report was released on Friday, we wrote a commentary on the U.S. dollar. In light of the events over the weekend and Monday, we start with some comments on the global stock market selloff.

- The broad stock market benchmarks are down about 3% this morning as several factors have lined up to create conditions for a sharp global selloff. A batch of weak economic data, notably Friday’s jobs report, sparked concerns that the Federal Reserve (Fed) may have taken its higher for-longer rate policy too far.

- After such a strong rally since last fall, valuations, sentiment, and investor positioning had become stretched. What markets are experiencing today is an unwinding of that bullish positioning, which is particularly evident in the yen and the so-called carry trade. Japan’s Nikkei suffered its worst one-day decline since 1987.

- Where do we go from here? We anticipated more volatility, as we discussed in the LPL Research Midyear Outlook 2024. Some signs that the selling pressure may be near its nadir have already begun to emerge, including extreme readings on the VIX measure of implied volatility. Watch for signs of a capitulating Fed, timely evidence of a growing economy, and a successful test of the 200-day moving average on the S&P 500 for signs a bottom may be in.

- For more of our thoughts on this global bout of volatility, please follow the LPL Research blog.

ASSET ALLOCATION INSIGHTS

After the sharp August 5 decline, equities are nearing an attractive entry point. LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, while actively monitoring signs of bottoming. LPL Research continues to preach patience before buying this dip. Bottoming is a process.

Potential catalysts for a stock market turnaround include a signal from the Fed that they will be more aggressive with rate cuts, evidence that the economy is holding up okay rather than falling off a cliff, and some additional unwinding of trades by institutions that were caught off guard by these big moves (potentially carry trades involving the yen currency).

From a technical analysis perspective, watch the 200-day moving average on the S&P 500 at around 5,010 as a key area of support. The extreme reading on the VIX (which measures implied volatility in the options market) is one sign that this selloff could be overdone. The Relative Strength Index (RSI) is another, having just entered oversold territory. Still, expect volatility to remain elevated in the coming months as the market waits for more information and a better seasonality picture. The Committee maintains its modest overweight to fixed income, funded from cash, which can help buffer some of the equity volatility should economic conditions worsen.

THE DOLLAR IS ON A PATH TOWARD DECOMPRESSION

The stronger dollar prevails as the Fed’s “higher for longer” mantra remains intact, although as the currency market perceives that the Fed is firmly committed to initiating an easing cycle, the dollar should soon soften vis-à-vis its global peers. The Fed’s most recent statement from the July 31 Federal Open Market Committee (FOMC) meeting pointed to a September 18 rate cut if inflation continues to ease at a steady pace. The Fed will continue to be data-dependent until it feels confident inflation won’t turn higher once again. Similarly, Fed Chair Jerome Powell has invoked the Fed’s “maximum employment” mandate numerous times, suggesting they would reduce rates quickly if the labor market were to “deteriorate.” Under these conditions, the dollar would weaken as a more “dovish” Fed would hasten to reduce rates to support the economy. Accordingly, the dollar should ease as monetary policy transitions towards a more moderate stance with either concerns over the economic landscape or declining inflation serving as catalysts. The recent rout in equity markets ─ triggered by a host of weaker economic data releases ─ pushed the dollar to its lowest level in 2024 as economic concerns suggest the Fed will be required to introduce a series of rate cuts at a faster pace throughout the year, or if deemed necessary, introduce a rate cut in between meetings.

THE DOLLAR AMID WORLD CURRENCIES

The U.S. dollar trades against a basket of its global peers, including the euro, British pound, Japanese yen, Canadian dollar, Swedish krona, and Swiss franc. These currencies comprise the U.S. Dollar Index, commonly referred to as the DXY.

In the parlance of currency traders and economists, the persistently “hawkish” tone of the Fed created an “interest rate differential” with other world currencies, i.e., the DXY counterparts. As global central banks began to position monetary policy for interest rate easing cycles, their respective currencies weakened against the dollar, as the Fed’s rhetoric made it clear that a “higher for longer” policy would continue as long as inflation remained elevated.

The dollar remained exceptionally strong as Fed officials were steadfast in their nearly singular objective to quell inflationary pressures.

Within the DXY, all central banks associated with their respective currencies began to cut interest rates, with the lone exception of Japan, which only recently began to raise interest rates following decades battling deflation. The Fed has remained on the sideline with a “pause” in rates and is only now indicating that the September FOMC meeting is in play for easing monetary policy.

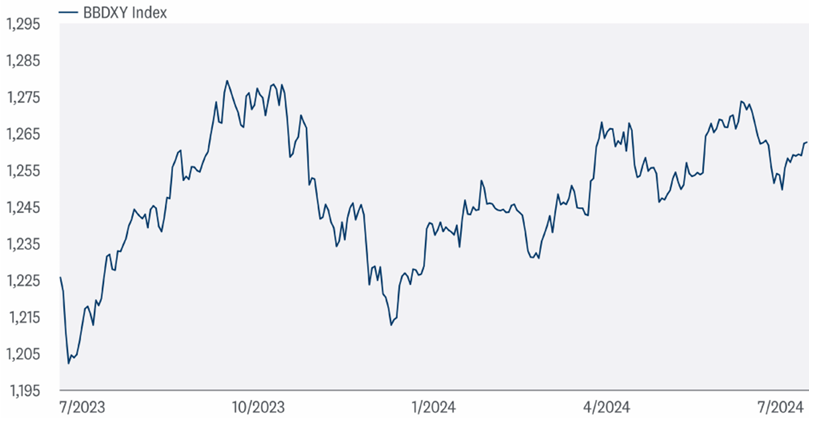

THE FED’S “HIGHER FOR LONGER” STANCE HAS BEEN SUPPORTING THE DOLLAR

Source: LPL Research, Bloomberg 08/01/24

Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. The Bloomberg Dollar Spot Index (BBDYX) tracks the performance of a basket of leading global currencies versus the US dollar.

STRONG DOLLAR EXERTING PRESSURE ON WEAKER CURRENCIES

Based on International Monetary Fund (IMF) data, and adjusting for inflation, the dollar is nearing its post-1985 peak, a level that led to the Plaza Accord, an agreement crafted by the then-G-5 nations in September 1985 at the Plaza Hotel in New York City. France, Germany, Great Britain, Japan, and the U.S. agreed to maneuver their currencies in a concerted effort to depreciate the dollar via collaborative interventions in the currency market.

A strong dollar can exert excessive pressure on other currencies, especially those in emerging markets. Recently, Vietnam and Indonesia have intervened in their currency markets to bolster their respective currencies, as South Korea and Malaysia have both attempted to bolster their currencies with so-called verbal interventions.

The Japanese yen has come under immense pressure against the dollar as the Japanese central bank struck a “dovish” tone regarding future monetary policy. The downward slope of the yen — which has been the weakest since 1967 — required possibly three interventions over the past several month mounting to billions of dollars to strengthen the yen against the dollar. However, at the end of July, the Bank of Japan (BOJ) turned “hawkish”, raising interest rates for the second time in decades and signaling further hikes. The yen has climbed to an acceptable and more stable level based on the potential for tighter monetary policy.

THE DOLLAR AS THE WORLD’S RESERVE CURRENCY

Despite attempts by China and Russia in particular, to thwart the hegemony of the dollar as the world’s reserve currency, the dollar continues to be represented in nearly 88% of all global financial transactions. A reserve currency by its very nature requires stability, reliability, and transparency, and notwithstanding the fierce debates surrounding the debt ceiling negotiations, the U.S. pays its bills to all of its creditors.

TRANSITIONING TOWARDS A SOFTER DOLLAR

With each new inflation-related data release, the dollar should ease slightly if the trajectory of inflation is falling at a faster pace. This, in turn could soften the dollar as currency markets begin to factor in lower rates ahead and a decidedly more “dovish” Fed.

It is expected that Fed Chair Jerome Powell will edge closer towards confirming the shift in monetary policy at the Fed’s August 22–24 Jackson Hole conference for global central bankers.

A more modest dollar is helpful for U.S. exporters, as nearly 40% of the revenue from S&P 500 companies is derived from outside the U.S.

A softer dollar helps emerging markets service dollar denominated debt, as well as helping with dollar-denominated imports.

In general, global financial conditions ease considerably as the dollar moderates.

Although expectations are focused on September for the first rate cut, if the economic backdrop — particularly the labor market — signals a more rapid deterioration, the Fed may intensify its rhetoric as a form of verbal intervention, or they may lower rates in between meetings if the totality of the data argues for it.

Clearly, the Fed is at a transition point as it balances its price stability mandate with its maximum employment mandate.

Similarly, the dollar follows the data assiduously and will adjust appropriately, as it is poised to accommodate to the changing economic calculus.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

The prices of small cap stocks are generally more volatile than large cap stocks.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

LPL Financial does not provide investment banking services and does not engage in initial public offerings or merger and acquisition activities.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

RES-0001659-0724W | For Public Use | Tracking #610571 (Exp. 08/2025)

Thoughts on Global Selloff and the Dollar’s Path to Decompressing | Weekly Market Commentary | August 5, 2024

Before the jobs report was released on Friday, we wrote a commentary on the U.S. dollar. In light of the events over the weekend and Monday, we start with some comments on the global stock market selloff.

ASSET ALLOCATION INSIGHTS

After the sharp August 5 decline, equities are nearing an attractive entry point. LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its tactical neutral stance on equities, while actively monitoring signs of bottoming. LPL Research continues to preach patience before buying this dip. Bottoming is a process.

Potential catalysts for a stock market turnaround include a signal from the Fed that they will be more aggressive with rate cuts, evidence that the economy is holding up okay rather than falling off a cliff, and some additional unwinding of trades by institutions that were caught off guard by these big moves (potentially carry trades involving the yen currency).

From a technical analysis perspective, watch the 200-day moving average on the S&P 500 at around 5,010 as a key area of support. The extreme reading on the VIX (which measures implied volatility in the options market) is one sign that this selloff could be overdone. The Relative Strength Index (RSI) is another, having just entered oversold territory. Still, expect volatility to remain elevated in the coming months as the market waits for more information and a better seasonality picture. The Committee maintains its modest overweight to fixed income, funded from cash, which can help buffer some of the equity volatility should economic conditions worsen.

THE DOLLAR IS ON A PATH TOWARD DECOMPRESSION

The stronger dollar prevails as the Fed’s “higher for longer” mantra remains intact, although as the currency market perceives that the Fed is firmly committed to initiating an easing cycle, the dollar should soon soften vis-à-vis its global peers. The Fed’s most recent statement from the July 31 Federal Open Market Committee (FOMC) meeting pointed to a September 18 rate cut if inflation continues to ease at a steady pace. The Fed will continue to be data-dependent until it feels confident inflation won’t turn higher once again. Similarly, Fed Chair Jerome Powell has invoked the Fed’s “maximum employment” mandate numerous times, suggesting they would reduce rates quickly if the labor market were to “deteriorate.” Under these conditions, the dollar would weaken as a more “dovish” Fed would hasten to reduce rates to support the economy. Accordingly, the dollar should ease as monetary policy transitions towards a more moderate stance with either concerns over the economic landscape or declining inflation serving as catalysts. The recent rout in equity markets ─ triggered by a host of weaker economic data releases ─ pushed the dollar to its lowest level in 2024 as economic concerns suggest the Fed will be required to introduce a series of rate cuts at a faster pace throughout the year, or if deemed necessary, introduce a rate cut in between meetings.

THE DOLLAR AMID WORLD CURRENCIES

The U.S. dollar trades against a basket of its global peers, including the euro, British pound, Japanese yen, Canadian dollar, Swedish krona, and Swiss franc. These currencies comprise the U.S. Dollar Index, commonly referred to as the DXY.

In the parlance of currency traders and economists, the persistently “hawkish” tone of the Fed created an “interest rate differential” with other world currencies, i.e., the DXY counterparts. As global central banks began to position monetary policy for interest rate easing cycles, their respective currencies weakened against the dollar, as the Fed’s rhetoric made it clear that a “higher for longer” policy would continue as long as inflation remained elevated.

The dollar remained exceptionally strong as Fed officials were steadfast in their nearly singular objective to quell inflationary pressures.

Within the DXY, all central banks associated with their respective currencies began to cut interest rates, with the lone exception of Japan, which only recently began to raise interest rates following decades battling deflation. The Fed has remained on the sideline with a “pause” in rates and is only now indicating that the September FOMC meeting is in play for easing monetary policy.

THE FED’S “HIGHER FOR LONGER” STANCE HAS BEEN SUPPORTING THE DOLLAR

Source: LPL Research, Bloomberg 08/01/24

Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. The Bloomberg Dollar Spot Index (BBDYX) tracks the performance of a basket of leading global currencies versus the US dollar.

STRONG DOLLAR EXERTING PRESSURE ON WEAKER CURRENCIES

Based on International Monetary Fund (IMF) data, and adjusting for inflation, the dollar is nearing its post-1985 peak, a level that led to the Plaza Accord, an agreement crafted by the then-G-5 nations in September 1985 at the Plaza Hotel in New York City. France, Germany, Great Britain, Japan, and the U.S. agreed to maneuver their currencies in a concerted effort to depreciate the dollar via collaborative interventions in the currency market.

A strong dollar can exert excessive pressure on other currencies, especially those in emerging markets. Recently, Vietnam and Indonesia have intervened in their currency markets to bolster their respective currencies, as South Korea and Malaysia have both attempted to bolster their currencies with so-called verbal interventions.

The Japanese yen has come under immense pressure against the dollar as the Japanese central bank struck a “dovish” tone regarding future monetary policy. The downward slope of the yen — which has been the weakest since 1967 — required possibly three interventions over the past several month mounting to billions of dollars to strengthen the yen against the dollar. However, at the end of July, the Bank of Japan (BOJ) turned “hawkish”, raising interest rates for the second time in decades and signaling further hikes. The yen has climbed to an acceptable and more stable level based on the potential for tighter monetary policy.

THE DOLLAR AS THE WORLD’S RESERVE CURRENCY

Despite attempts by China and Russia in particular, to thwart the hegemony of the dollar as the world’s reserve currency, the dollar continues to be represented in nearly 88% of all global financial transactions. A reserve currency by its very nature requires stability, reliability, and transparency, and notwithstanding the fierce debates surrounding the debt ceiling negotiations, the U.S. pays its bills to all of its creditors.

TRANSITIONING TOWARDS A SOFTER DOLLAR

With each new inflation-related data release, the dollar should ease slightly if the trajectory of inflation is falling at a faster pace. This, in turn could soften the dollar as currency markets begin to factor in lower rates ahead and a decidedly more “dovish” Fed.

It is expected that Fed Chair Jerome Powell will edge closer towards confirming the shift in monetary policy at the Fed’s August 22–24 Jackson Hole conference for global central bankers.

A more modest dollar is helpful for U.S. exporters, as nearly 40% of the revenue from S&P 500 companies is derived from outside the U.S.

A softer dollar helps emerging markets service dollar denominated debt, as well as helping with dollar-denominated imports.

In general, global financial conditions ease considerably as the dollar moderates.

Although expectations are focused on September for the first rate cut, if the economic backdrop — particularly the labor market — signals a more rapid deterioration, the Fed may intensify its rhetoric as a form of verbal intervention, or they may lower rates in between meetings if the totality of the data argues for it.

Clearly, the Fed is at a transition point as it balances its price stability mandate with its maximum employment mandate.

Similarly, the dollar follows the data assiduously and will adjust appropriately, as it is poised to accommodate to the changing economic calculus.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

The prices of small cap stocks are generally more volatile than large cap stocks.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

LPL Financial does not provide investment banking services and does not engage in initial public offerings or merger and acquisition activities.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

RES-0001659-0724W | For Public Use | Tracking #610571 (Exp. 08/2025)

Recent Posts

Categories

SIGN UP TO RECEIVE OUR WEEKLY NEWSLETTER

Sign up to get interesting news and updates delivered to your inbox.